Department of Tourism Youth Development Learnership Programme StipendR3600

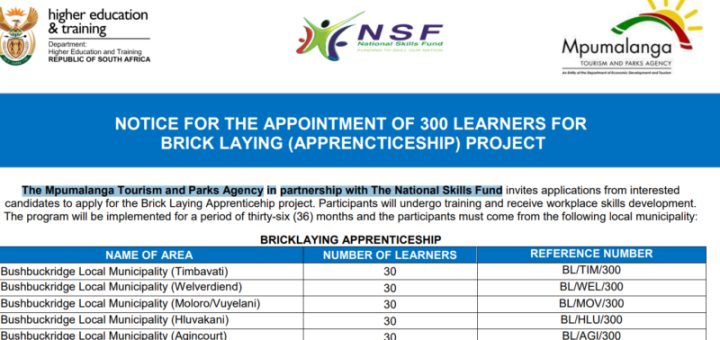

Three Hundred(300) Brick Laying Apprenticeship Learners Required by The Mpumalanga Tourism and Parks Agency in Partnership with The National Skills Fund(NSF) Department of Tourism Youth Development Learnership Programme StipendR3600 DURATION: 36 Months LOCATION: South...